Top Small Business Payroll Services for 2023

Content

Other services in the various plans include a workforce portal for employees, health benefits from SimplyInsured, time tracking, an HR support center and project management. Prices range between $45 and $125 per month, plus between $5 and $10 per employee. QuickBooks accounting software can be included as an add-on with each of these plans. These eight cheap payroll services also happen to be some of the best. With features from payment options and tax filing to direct deposits and more, these payroll services are great choices for small businesses. Each of these payroll software providers offers the necessary features, plus some extras, to satisfy nearly all payroll needs. Modern payroll processing vendors offer a full array of services including mobile access, process automation, cloud-based technology, online payroll and employee quality-of-life benefits.

Whether you found QuickBooks Payroll lacking, or just want to see what else is out there, we’re here to help. If you have employees spread across different states or around the globe, you will need to meet more regulations. With hybrid and remote work becoming commonplace as a result of the pandemic, you must consider if you might have people working from different locations in the future. TriNet is a good fit for small businesses that want to use an “employer of record” system and offload some legal liability in exchange for not having full control over employment policies.

EMPLOYEE SELF-SERVICE

In addition we called to cancel our payroll service and the representative told us a account was canceled for payroll. However they continue to charge us month after month $500 and refused to refund any amount citing their contract stipulated no refunds. QuickBooks hides behind their giant contract of incidentals that consumers unaware about, and when you called to cancel they will tell you it’s canceled but in reality it’s not.

The report shows employees their health insurance and retirement contributions, as well as any bonuses or other benefits they received. This is helpful in efforts to retain employees in today’s competitive job market. Gusto is an intuitive, easy-to-use software platform that most users can learn quickly with minimal training. Running payroll, for example, is as easy as logging in, clicking the Run Payroll tab, and filling out the fields regarding employee hours, vacation time, bonuses, commissions, etc. Lying thieves, Add Quickbooks Online Payroll Service and they failed to pay taxes in which they ended up paying to the federal government. Customer service is like talking to China, India, Mexico, Thailand and Vietnam all rolled into one.

Justworks Plans & Pricing*

These are criminal corporate weasels with zero integrity, zero honor, and absolutely zero Ethics. Our California corporate ID number was listed incorrectly in our payroll account when set up, so after our first payroll the CA tax authority threw an error and didn’t accept the quarterly tax form. I had to call Intuit’s customer support and wait on hold with many incompetent support staff to simply correct the ID number in their system. This should have been something I could easily change myself in the portal, but no. Even their staff couldn’t figure out how to change this simple number.

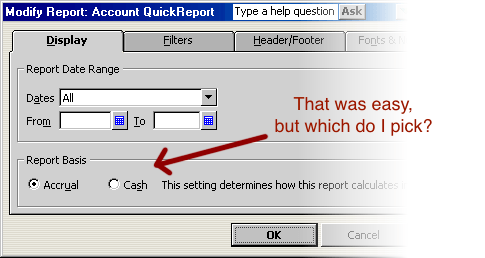

We bring you news on industry-leading companies, products, and people, as well as highlighted articles, downloads, and top resources. You’ll receive primers on hot tech topics that will help you stay ahead of the game. Square Payroll integrates seamlessly with Square POS, making it simple to use the same software for both POS and payroll purposes. Because QuickBooks allows you to do things like delete entries or restate results, it’s not technically GAAP compliant.

Intuit QuickBooks Online Payroll’s pricing

Others https://drkiritsaha.com/clomid-generisk-information-och-anvandning/ provide partial setup wizards and leave the rest to you. These setup wizards ask for information about your company, such as its address and Employer Identification Number.

Can I get QuickBooks payroll without subscription?

If you choose not to subscribe to any of the QuickBooks Desktop Payroll Services, you can set up payroll without a subscription. QuickBooks Desktop won't calculate your payroll taxes or provide payroll tax forms. You must manually calculate your payroll tax figures and enter them for each paycheck.

There are optional add-ons for time and attendance and personnel tracking as well. Deluxe uniquely offers the option to use its HR features in conjunction with your existing payroll provider. This means you could integrate capabilities like benefits administration and paid time off tracking without disrupting your existing payroll service. The platform provides payroll for both employees and contractors—and even offers a low-cost contractor-only plan.

#1 Payroll Software

Several Intuit® Online Payroll Services For Small Business also say that it lacks advanced functionality that larger organizations need. Late fall of 2021 Intuit Payroll automatically switched me to QB Payroll. QB payroll is a very badly designed product and their customer services folks are the worst out there. Not trained and folks in the Asian countries have no idea about the product. I have been trying to get an issue resolved for the past 2 days – 8 calls and 4 hrs later still no resolution to my issue. Super frustrating as they say they will transfer the call and I have to authenticate myself again and then again I get transferred over. Can’t believe a big company like Intuit/QB is operating this way.

- If you’re having trouble with the service, you can live chat with customer service representatives from directly within the app.

- The Elite plan goes a step further and covers up to $25,000 per year in payroll tax penalties resulting from mistakes an employer might have made.

- Online payroll software is critical in ensuring your employees are paid on time and accurately.

- You must have a ballpark figure in mind that you are willing to pay monthly or annually to meet your payroll needs.

https://personal-accounting.org/ QuickBooks Payroll offers an affordable, easily navigated payroll software application that is designed for small business owners. For a small business such as yourself, we recommend Intuit Online Payroll. In addition to payroll with full tax service, Intuit can also handle workers comp insurance, retirement plans, track PTO w/ accruals and much more. Basically, Intuit Enhanced Payroll is everything a small or medium-sized business needs to speed up the payroll process. It features the same simple interface of other Intuit products and, just in case you need extra help, direct tech support is available to all paying clients.

QuickBooks® Online Payroll Services for Small Business

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.